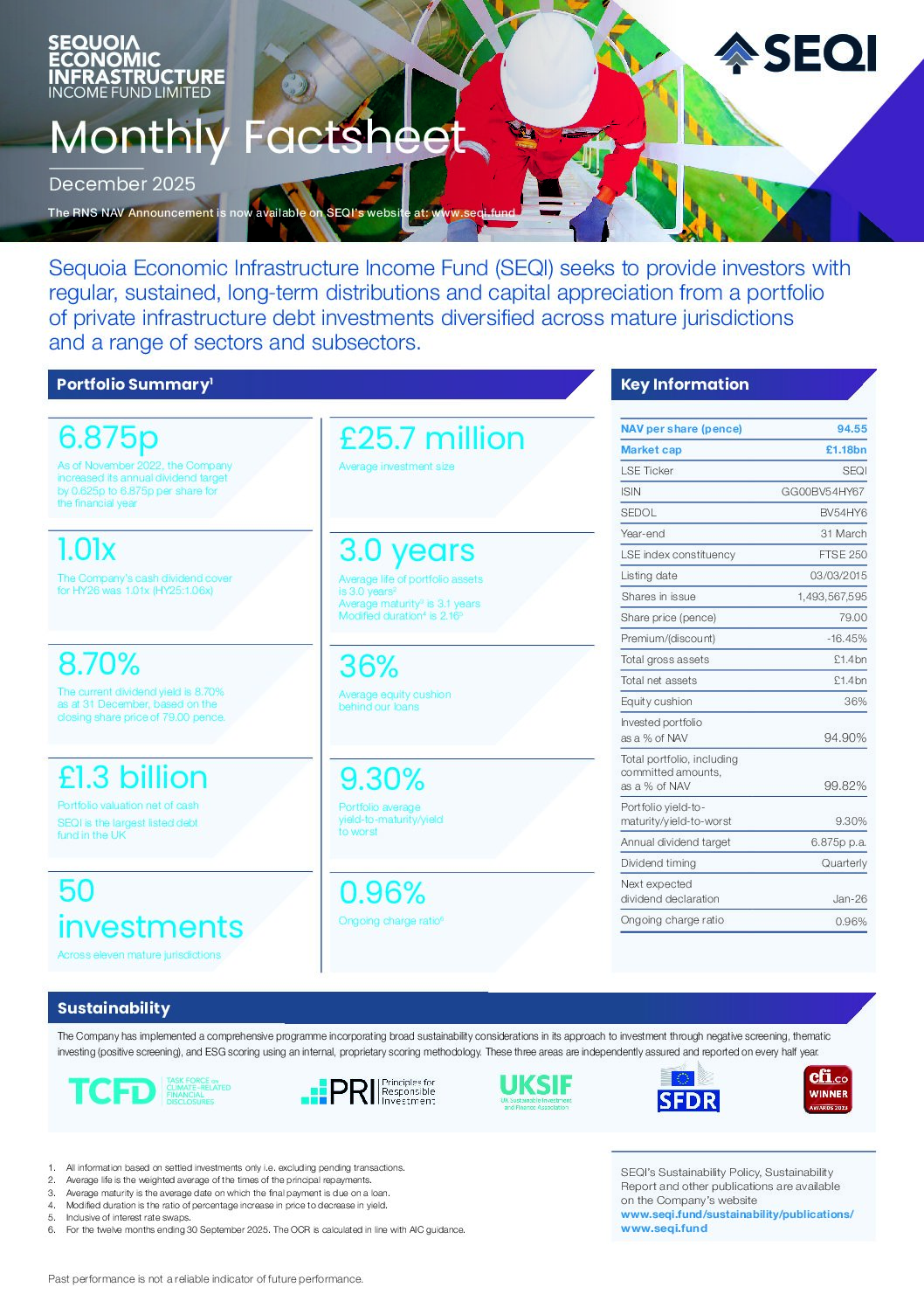

A well diversified income generating portfolio

SEQI is a diversified infrastructure fund with a broad portfolio of private debt investments and bonds across multiple sectors, sub-sectors and mature jurisdictions.

Read more26.2%

Digitalisation

- Data centres 10.1%

- Broadband and Fibre 8.3%

- Telecom towers 7.8%

20.4%

Power

- Base load 6.2%

- Other Electricity Generation 4.9%

- Interconnector 4.3%

- Standby Generators 3.8%

- Nuclear Power 0.8%

- Energy transition 0.4%

11.2%

Transport – vehicles

- Specialist shipping 4.6%

- Health & Safety 4.0%

- Rolling stock 2.6%

10.8%

Other

- Waste-to-energy 3.8%

- Renewables Equipment & Services 3.6%

- Hospitals 2.3%

- Hospitality 0.7%

- Social Infra 0.3%

- Schools 0.1%

8.7%

Utility

- Midstream 5.2%

- Utility services 3.5%

8.6%

Accommodation

- Healthcare 7.1%

- Student housing 1.5%

8.5%

Renewables

- Solar and wind 8.5%

5.6%

Transport – systems

- Ferries 3.2%

- Port 2.3%

- Road 0.1%

All data correct as of 31 December 2025.

Monthly factsheet

SEQI provides investors with market-leading transparency through monthly reporting of NAV and portfolio performance.

View all updatesOur ESG goals

- Negative screening

- Thematic investing (positive Screening)

- In-house ESG scoring